Do you just need 1 motion under $10M ARR?

Dave Boyce on the benefits of nailing one motion now before you add to your GTM

We recently had

join us on The Revenue Formula Podcast to talk about managing multiple GTMs. You can listen to the entire episode here.During the taping, we started talking about the realities of running multiple motions at an early stage, and I realized that it’s exactly what so many of us have gotten in trouble with (me included).

So, in today’s Revenue Letter, I’m going to break down some of Dave’s thoughts and give my early-stage readers some advice on building motions for scale.

You’re a new GTM leader at a <$10M ARR company, and you’re under pressure to draw up a way to double that.

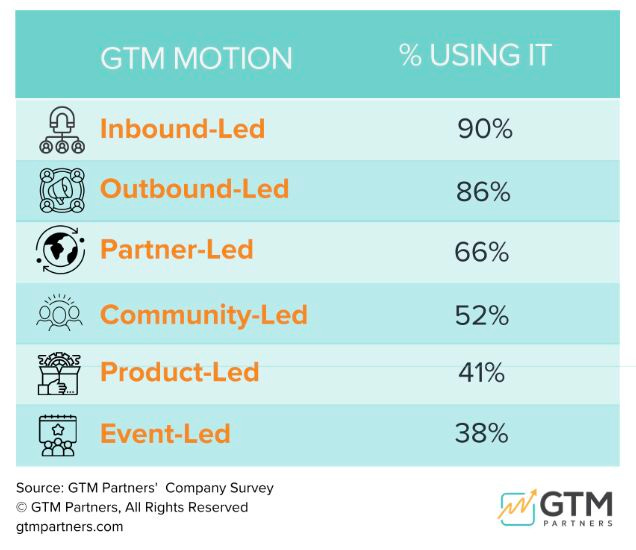

So what do a lot people do in this situation? They add a new motion.

“Let’s add a PLG motion next to inbound.”

“Let’s add Mid-market on top of SMB.”

“Let’s add a Partner channel on top of community.”

It’s incredibly tempting.

You’re already going to bet on a motion. So why not bet on a number of them and see which one pans out?

Plus you’ll expand out to these motions eventually, right?

Yes, you’re going to add a new motion eventually. Nobody is debating that.

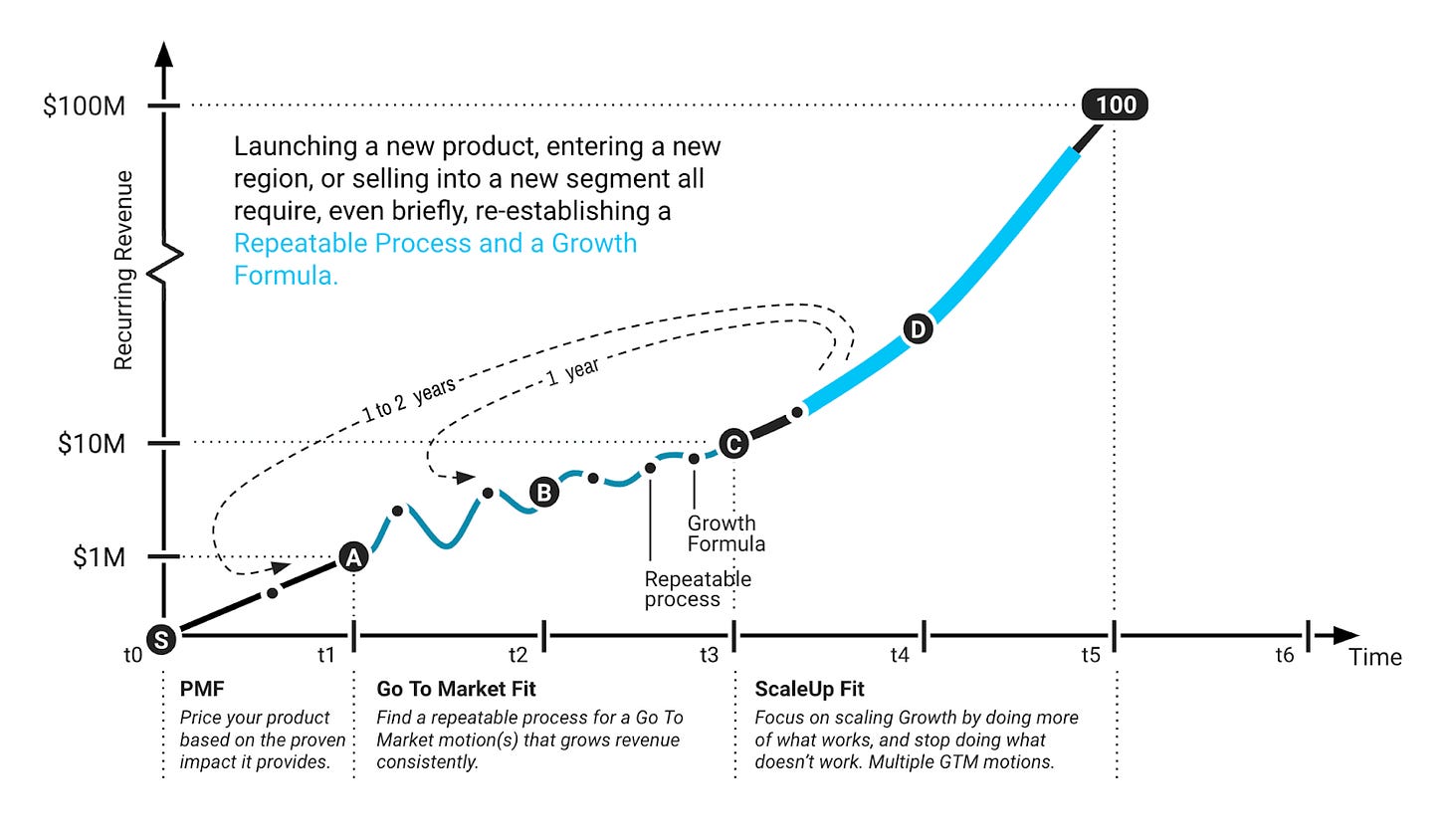

But the problem is at this stage you’re looking for GTM-Fit, so the name of the game is how can you make sure each motion is ready to scale.

Multiple motions at this stage will add chaos on top of chaos.

One more motion means new systems, processes, and more overhead.

And what if your new motion intersects with your other ongoing motion?

You want to test and monitor each motion until you have a clear sequence of events, know they’re repeatable, and have proof that they’re predictable.

I.E., If you constantly give it the same inputs, it’ll give you consistent output.

If you have two motions that interact with each other, all of a sudden, it’s going to be that much harder to figure out what works and what doesn’t.

According to Dave Boyce, at this stage, you should (ideally) only be running one motion at a time.

Getting ready for scale

First, how do you know a motion works? AKA, have you gotten GTM-fit?

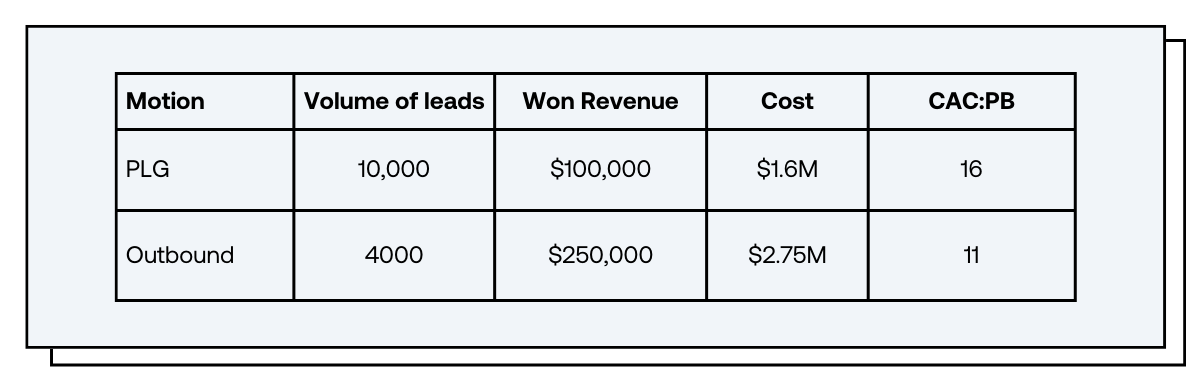

CAC Payback.

That means taking out your pencils and spreadsheets and figuring out: what's the total amount that you’re spending in marketing and sales on average to acquire 1 new customer?

And how long will it take me to recoup that investment in months?

And if that is 12 months or lower, it’s probably in pretty good shape.

In the best of cases, it’ll take at least a couple of years to get there.

The rub? Before you can get there, you’ll need to look at your GTM as a revenue architect and understand everything you can about your motion.

That means defining, testing and optimizing each part of your motion sequences.

For example, let’s say you’re running and outbound motion in the UK. The next step? You decided to add Germany.

But nobody wants to talk English with you. So you hire locally, pitch differently, and create more local cases for enablement.

All of a sudden, that one motion becomes thousands of smaller experiments to get right.

And that should be your first priority before you add another motion to the mix.

A good rule of thumb? If you can get a single motion to carry you to at least $10M ARR, then you have enough stability to add your next motion.

Keep Reading:

Make sure you check out Dave Boyce. He wrote about the Multi-GTM Theory here

We also had Dave on our podcast talking about the same thing. Listen to the full episode here.

P.S. Once you're at the stage of scaling multiple motions, how are you tracking them? Are they forecastable? And how predictable is your engine as a whole? And trust me, at this stage, a Google Sheet will only tell you so much. At Growblocks, we’ve created a revenue platform with revenue architects like you in mind. Visit Growblocks.com to learn more, or email me and ask me anything.