At +$100M and growing 80% YoY, this is how Pleo manages growth

Breaking down complexity and managing growing pains as a hypergrowth company

Hey, Toni from Growblocks here! Welcome to another Revenue Letter!

This weekly email is my way to share knowledge and build a community of people who love to learn more about growing revenue in a data-driven and scientific way.

Anything in particular you want to hear my thoughts on? Drop me an email, and I might use it in my next article.

I recently sat down with Arun Mani, the CRO at Pleo, to talk about growing 80% at 100m ARR. Which is insane. And is something that Pleo went through.

30,000+ customers

$100M+ ARR

80% Growth YoY

$4.7B valuation

But that kind of growth comes with its fair share of growing pains.

You’re running multiple segments and markets. And everything slightly earlier and faster than anyone is comfortable with.

Constantly stretching the system at its seems.

Every change you make doesn’t is outdated and needs to be revisited in 6 months.

Every structure you create needs to be changed before the end of the year.

Everything is constantly in flux.

That means the decisions you make today will quickly become outdated.

These are big enough challenges for any leader, but add in your ever-growing GTM teams?

Now you’re risking capsizing the company if you don't execute right.

So how does Arun and his team keep that growth up?

Pleo’s Domains

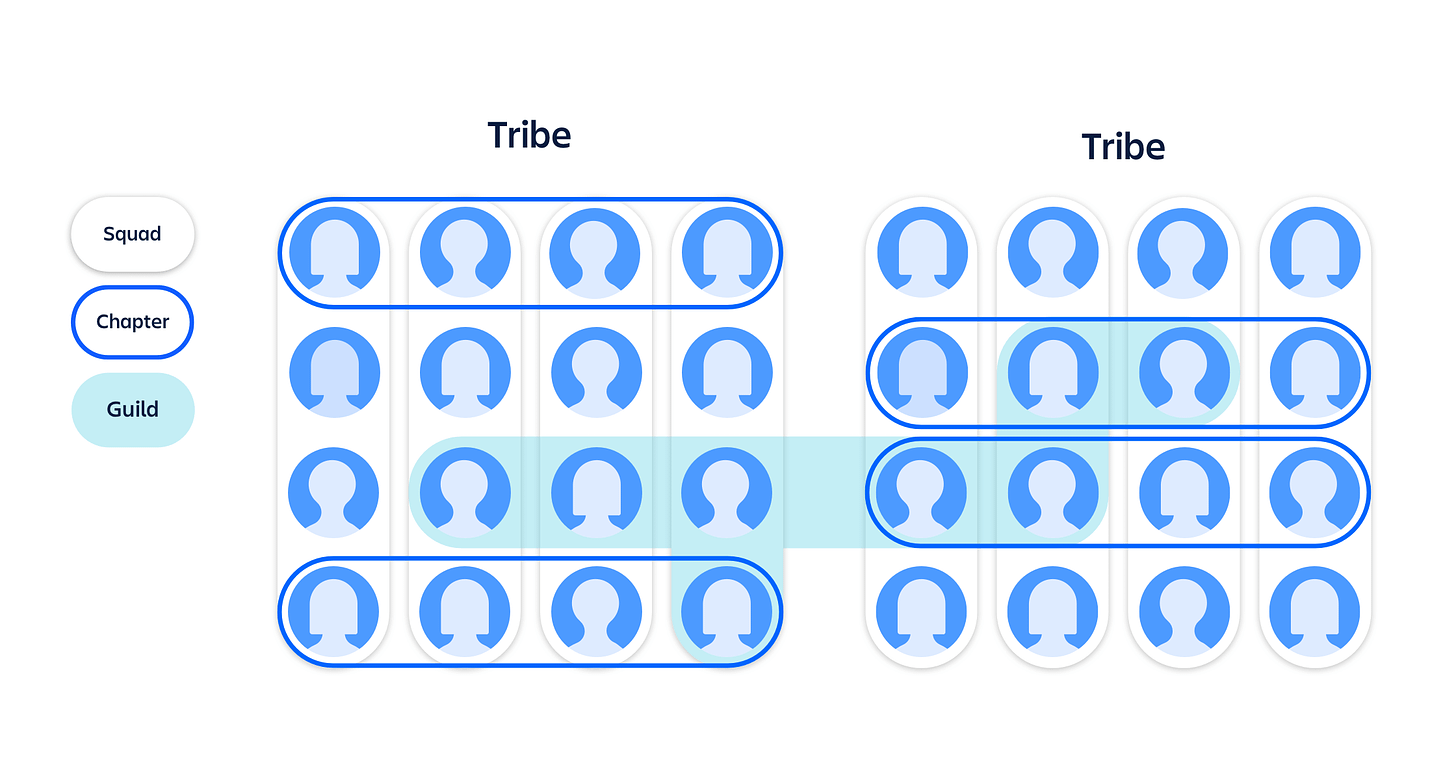

Most companies at this scale run a matrix organization. A structural framework that enables collaboration across different business functions and teams.

Pleo does things a little differently, as they took lessons from leading Nordic companies like Spotify and Klarna on how to structure this insane growth in the best way.

What that essentially means is that for every big problem statement or area, they have a domain.

Each domain then has a leader.

And under them, they will have a number of tribes and competencies.

For example, their SMB domain is not just run with sales and marketing people.

They’ll also have engineers and product managers.

In their case, it’s anyone invested heavily in PLG motions.

These domains allow Pleo to selectively combine teams under a single leader where synergies are high, rather than rigidly adhering to functional silos.

This flexibility allows Pleo to adapt to different market needs without compromising on the core values and strengths of its product.

But just as Spotify and Klarna showed, this doesn't mean that the domain leader is the actual manager of sales, marketing, product and engineering folks.

These teams are still managed by their functional leaders.

Balancing needs for different markets/segments

For the most part, a company like Asana could take their product (maybe sprinkle in some localization) and expand into any market. Then add a new Sales and CS team, and boom there you go.

That isn’t true for Pleo

The harsh reality for them (and most fintech) is that regulations affect each market differently. Between bank integrations and money transfer laws, it can be a completely different product depending on the market they’re operating in.

That means the strategy that works in the UK, won’t work in the EU, which won’t work in the US.

With these regional nuances in mind, how do you decide what to focus on?

It starts with context switching and keeping distinct regional discussions separate.

Anything in Pleo’s core thread that helps every single customer is discussed at the global forums. But when it comes to each individual country or segment, they instead get their own forum in the form of another meeting or discussion.

These forums help with individual country prioritization, but also stop Pleo from just focussing on optimizing for the global maximum. Because doing that would always see the biggest market getting the biggest piece of the pie (in this case the UK), while seeing other smaller countries de-prioritized.

Managing growth through the complexity

So, as we’ve established, Pleo has a lot of operations either running or being launched at the same time. They have a country dimension, broken down into their motions (predominantly SMB and midmarket), and all at different stages of development (Alpha, Beta, and Full Throttle).

Add unit economics and other factors such as CAC, LTV, and how much TAM is available in each segment… and now you’re really putting your RevOps team to work.

For example, Denmark SMBs have a solid PMF and lower CAC, so there’s a reason to invest more and go full throttle into the market.

By analyzing each market, segment, and motion combination, Pleo can predict outcomes more accurately and understand which part of their business is performing well or not. Because even if you hit your target, if you don’t know which engine fired or failed to fire, then you don’t really have the full picture.

What’s really cool about Pleo’s story is how they're able to break down their entire GTM and account for each individual dimension and associated metrics.

Managing the complexity of their engine is what really drives that growth, but it also puts a lot of pressure on their RevOps team.

You may not have as complex of an engine as Pleo, but if you want to achieve that kind of growth, you’ll need to approach your entire bowtie with that same level of granularity.

If you need a place to start, you can email me, and we can have a chat.

Or visit Growblocks.com and check out what we’ve been building to help teams drive revenue.