Definitive guide to Revenue Architecture: Part 1 - A framework for recurring revenue

10 years of knowledge in 4 posts

👋 Hey, Toni from Growblocks here! Welcome to a special Revenue Letter! Every week, I share cases, personal stories and frameworks for GTM leaders and RevOps.

This is the first part of a four-part series on revenue architecture. Over the next couple of weeks, I’ll provide structured outlines, core frameworks, and models that’ll help you grow in today’s SaaS environment.

Part 1: A framework for recurring revenue (This post)

Before we dive in, I didn't come up with most of this, I am truly standing on the shoulders of some giants:

Jacco van der Kooij (Winning by Design),

Sangram Vajre (GTM Partners)

Dave Kellogg (Balderton Capital)

Brian Balfour (Reforge)

Dave Boyce (Winning by Design)

David Skok (Matrix Partners)

Christoph Janz (Point 9 capital)

A huge inspiration for this series comes from Jacco van der Kooij who wrote the book on Revenue Architecture (literally).

As an exclusive first look for Revenue Letter subscribers, Jacco is giving away the first chapter for free. Get it here to get your copy. Or buy the full version here.

Last week we talked about the state of SaaS. Having observed the industry for more than a decade, it’s clear that things aren’t like they used to be.

The cost of growth is climbing, performance is down - and how companies are assessed by investors has fundamentally changed. If you missed it, you can read the post here.

Long story short: You’re either taking Jacco’s perspective of “Wow, what a great opportunity” (he clearly has lived in the US for too long) or you take a bit of my side “Holy f***, how are we going to get through this?”.

The solution to all this mayhem is strong revenue architecture applied at scale in your Go-to-Market. To succeed, you’ll need to be fluent in GTM frameworks and models instead of winging it with intuition.

The problem, though? All frameworks and insights are spread across so many different places. Getting a complete understanding is, at best, difficult.

And trust me, it took me over 10 years to get all of this etched into my brain.

That’s why we decided to put this into one simple place/series for you to either:

Refresh your memory - because you’re a pro (95% of my readers)

Or you have something to look up later

A framework for recurring revenue

Let’s start easy:

As a business model, SaaS is probably the absolute best there is. And it will continue to be like that for a while (that also includes Usage-based pricing models in my view).

But while it's great, it’s also the most sensitive business model to small changes. And when every metric is going sideways - like today - it’s pretty important to understand what dials to turn, and which ones to steer clear of.

While there are a lot of standards for SaaS models. In reality they only really make sense post $10m ARR. The stages before are sweat, art, and a heavy dose of luck. And you’ll find more useful information by looking up “how to build a start-up”.

But that’s not what we’re talking about today.

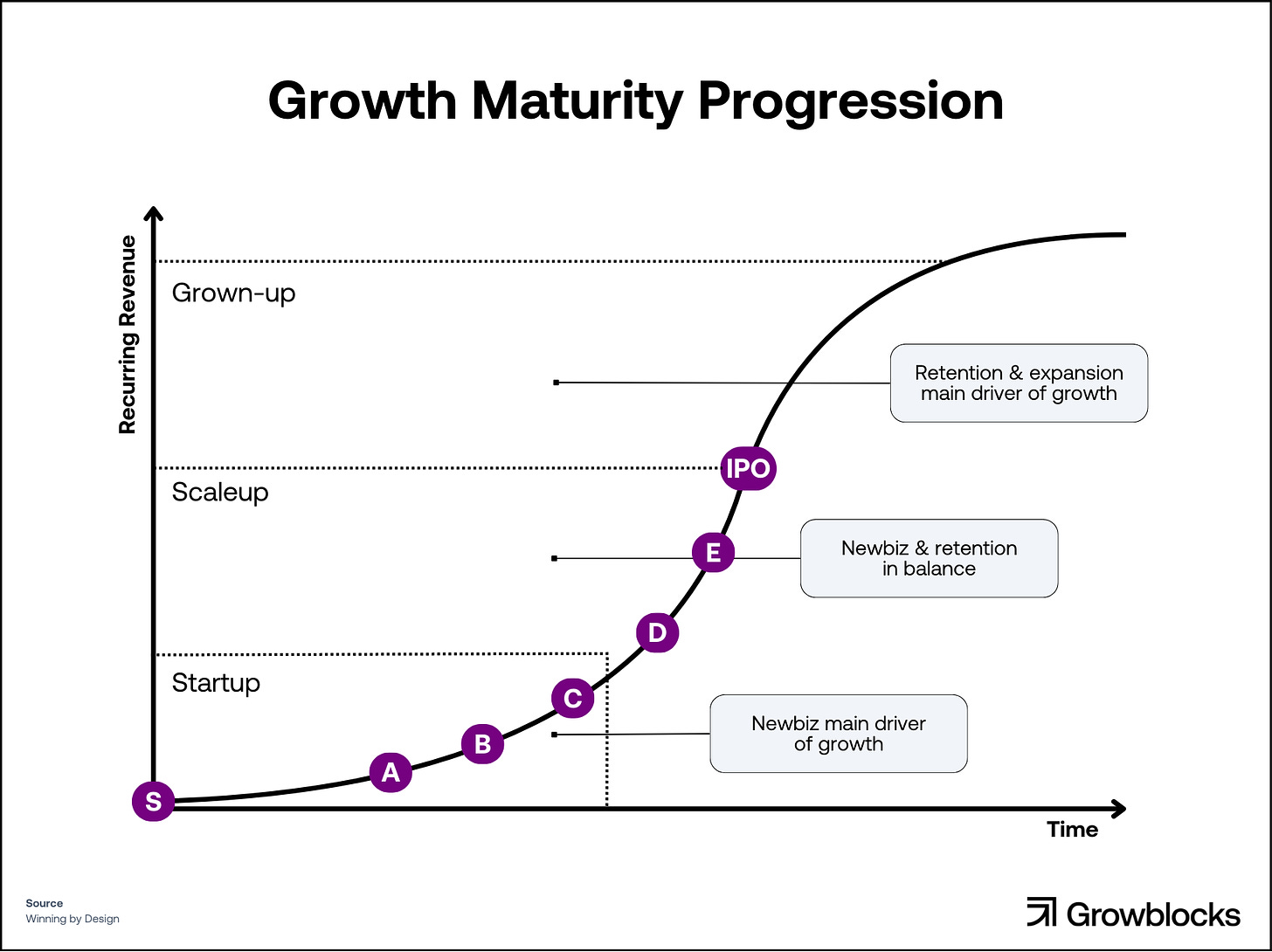

First, think about your growth as a massive S-curve. In reality you’ll have several overlapping S-curves below. But where you are on that curve dictates how you need to think:

When you’re early - the emphasis is on acquisition

As you scale up, there’s a balance between acquisition and retention

and ultimately revenue from customers will outpace newbiz

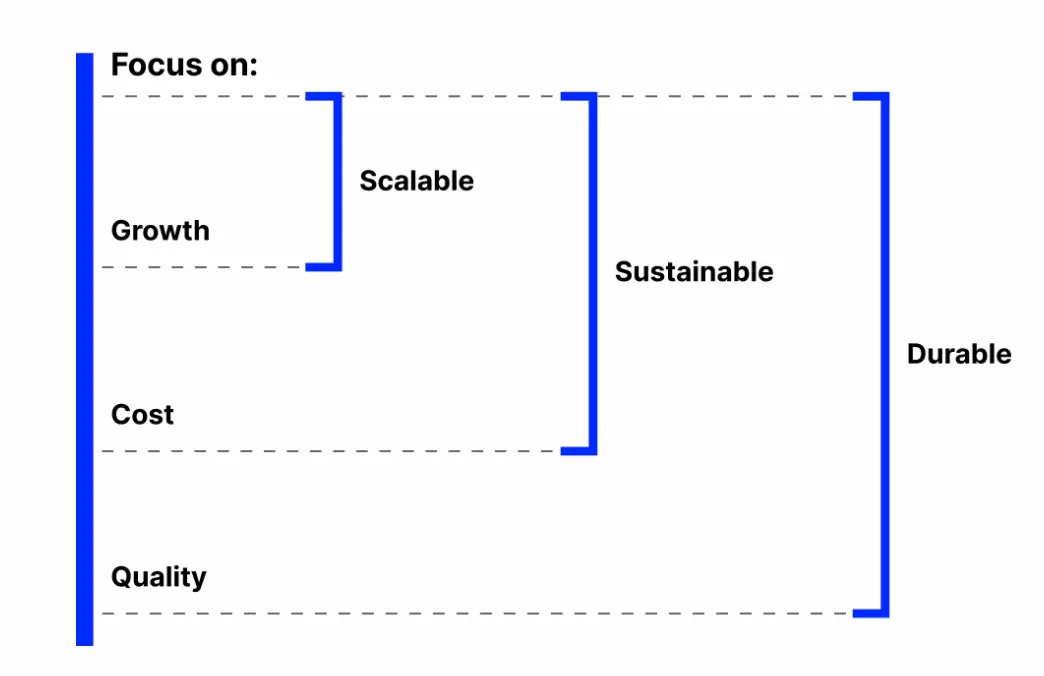

Second, once you’re out of the Product-Market-Fit stage (the sweat, art and luck stage), you need to find one or two channels to grow. The way these channels will be judged is by:

Their scalability

Their sustainability

Their durability

Big words, I know, but simply put, your CAC needs to be LESS than LTV, and you need to be able to keep doing it again and again. Also, these customers can’t churn like crazy.

If you have that with one or more channels, you have technically reached GTM-Fit. In many cases people say that this happens around $10M ARR.

We’ll go deeper into this concept in part 3, but for now, all you need to know is how the GTM consortium portrays it:

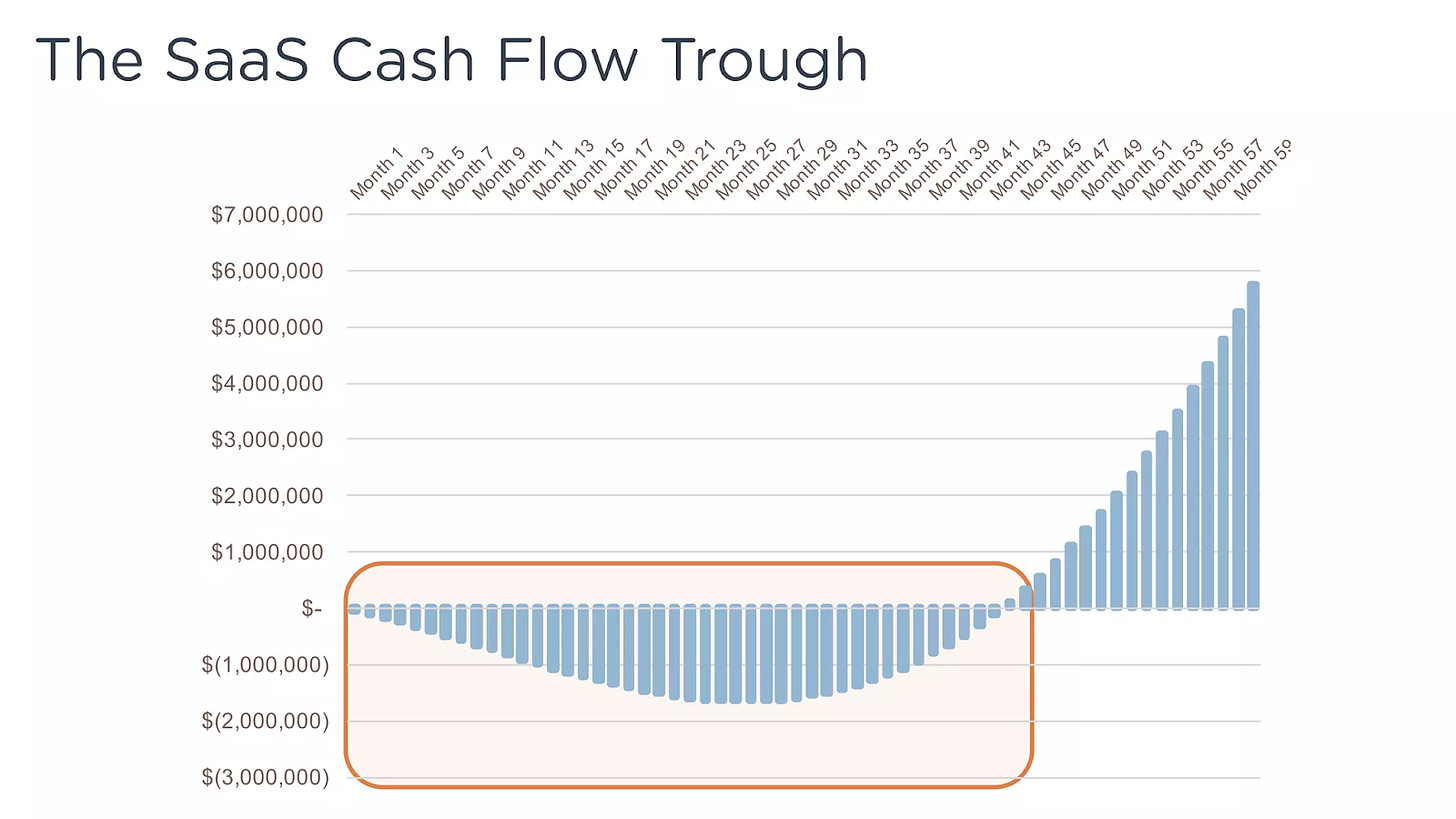

Third, SaaS companies have one big issue: they burn cash - a lot. That’s the simple result of pricing low entry fees and having them recur over time. In the old model, you would get all of that money upfront, which could pay for all the expenses immediately.

SaaS doesn’t work like that. It takes quite a lot of time to even recoup your Sales & Marketing costs. But even longer to also pay for Product & Engineering - and your CFO’s comp-package.

There is one counter-intuitive impact though: The more customers you add every month, the higher the burn in that month—simply because payments happen in the future. That means the faster the growth, the higher the burn.

This is an important dynamic to be aware of. Because the faster you scale, the more you’ll burn. And your CFO needs to understand that.

A Revenue Architecture Approach - The bowtie

SaaS wouldn’t be a recurring business without renewals. Yet, most businesses ignore that fact when looking at their funnel. Historically, the funnel ended at new business signed - but that’s the boring old world.

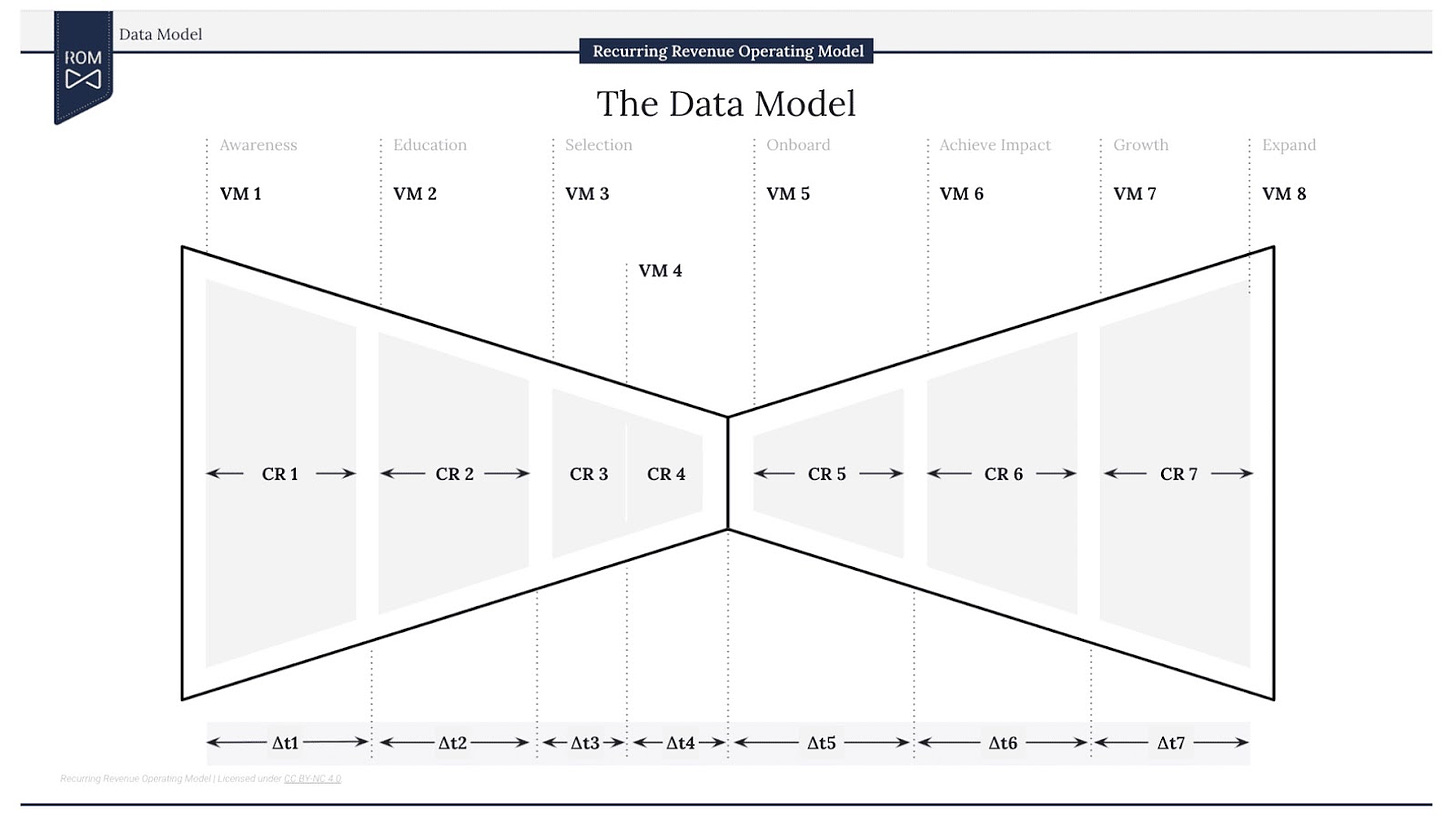

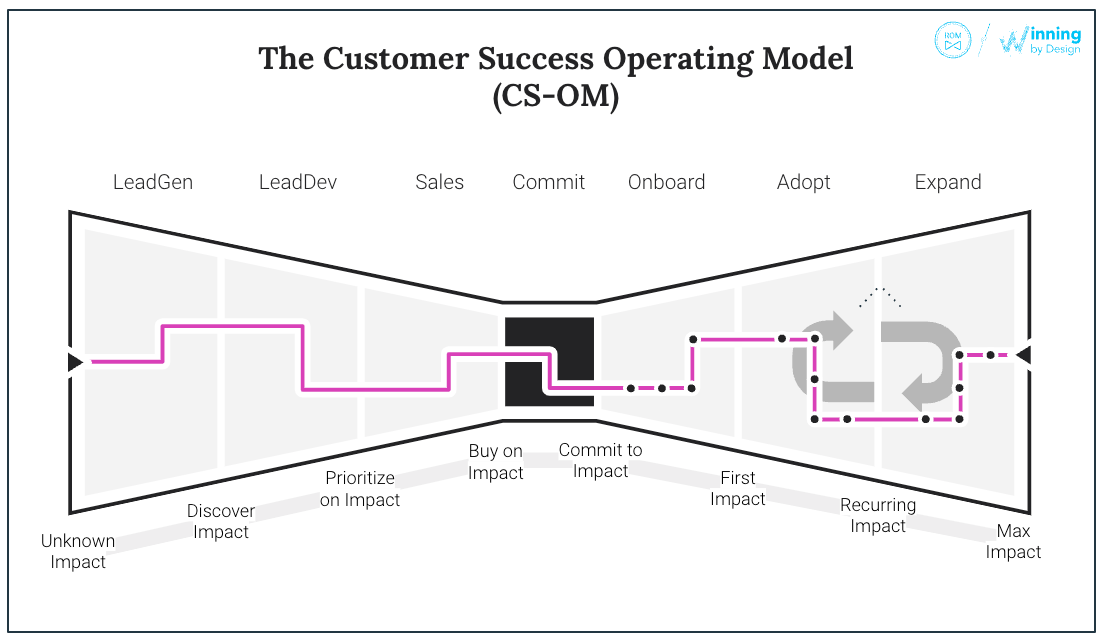

That’s why the first concept you genuinely need to understand is the bowtie, popularized by Winning by Design.

Shocker: instead of one funnel (like the Demand Waterfall) it consists of two funnels! A process to sell and a process to retain/expand. Simple but so, so powerful.

When businesses look at their performance, it’s common to run a sales forecast, and measure newbiz MRR and expansion MRR. We’re really good with hard metrics, but what you’ll notice with the bowtie: it’s considering volume, conversion rates and time.

Take a step back, and think about what’s really visualized here. It’s your revenue factory. It tells you that revenue is not just an outcome of a stellar AE team or volume of leads. If it takes X months for Y leads to become Z revenue, you can start applying a scientific approach to growing the business.

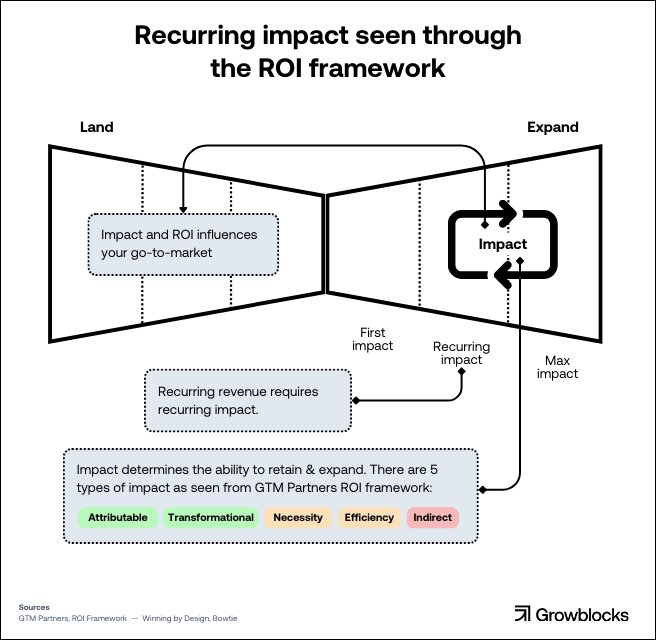

Recurring impact

Say you’ve landed a large account. They believed all the wonderful things you can do. They think your app will save them a ton of money and time. But after a year of using your tool, why will they really renew?

It’s because you have a recurring impact on their business.

It’s very simple. If Netflix stops putting out great movies and series, they’ll lose my subscription. The same goes for your fancy B2B app.

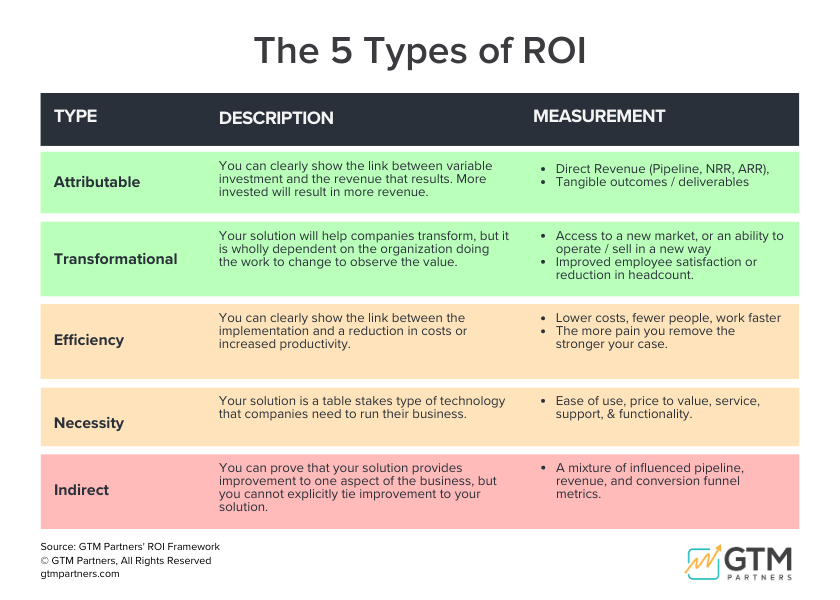

Once you reach a certain point on the S-curve, your job requires you to deliver clear impact to your customers. But how can you break down “impact”? Let’s use the ROI framework from GTM Partners.

When customers ask about ROI, the classic definition will focus on getting a $ amount in return for an investment. But not all software delivers a clear $ return. The five types of ROI are:

Yes, green is good. You probably also realized that you don’t want to be in the “indirect” bucket. And you’re right. When it comes to impact, it has to be pretty clear to the customer what they’re getting out of it.

When looking at the Bowtie - you have to realize that it’s inevitable that the right hand side becomes critical. In other words, if you’re not creating a positive impact for your customers: brace, brace, brace.

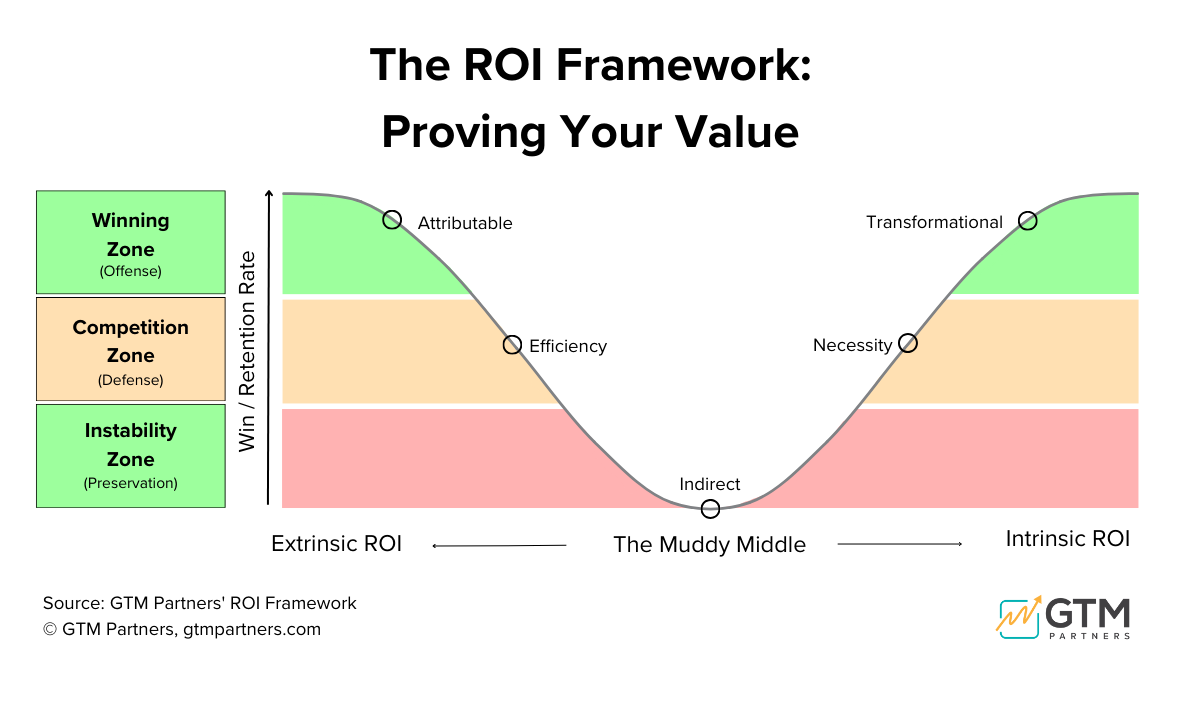

While most of us want to be attributable or transformational, the reality is simply that few of us are. So to ensure that your business is durable, you need to move upwards. This is how GTM partners look at it:

The winning zone (green): Companies here can prove a clear $ impact or completely new way of working - so chances of getting cut? Fairly low.

The competition zone (yellow): Vendors here can be successful, but competition is fierce and they’re at risk of commoditization.

The instability zone (red): You could also call it a dangerzone. If the economic environment worsens, guess what software gets cut first? The ones that can show clear impact.

Moving from one zone to the next is not an easy thing to do. It will require product and product marketing - and really your CEO - to achieve that.

There are some tricks like partnering with another vendor and adding to their offering - but it’s hard. By the way we just chatted with Sangram Vajre on our podcast about this. Listen to that whole episode here.

By combining the ROI types and bowtie in the graphic above, it gives you a clear picture of how you need to deliver recurring impact to drive recurring revenue.

Identifying what type of ROI your product delivers is super helpful in figuring out just how efficient your bowtie can be. And more importantly, it impacts your entire GTM.

As you move from red to green, you deliver a greater impact on your customers, giving them better reasons to buy or renew.

And if your impact isn’t in the green? Well, you better find a plan to get there.

Architecture in practice

I recently used Simpson's paradox to explain the importance of unblending your bowtie.

It simply means this: When you segment data, a previously clear trend can flip in the other direction. Pretty scary if you ask me. High potential for smart people with glasses messing up their “data-driven” recommendations.

According to a McKinsey study, the top quartile SaaS companies “understand the efficiency of their spend at a granular segment level and use it to adjust spending to segments that produce the highest returns”.

So, to say the least, unblending matters a great deal. Effectively, there are three layers of assessing an unblended funnel:

Who you’re acquiring (ICP)

What you’re selling (product(s) / impact)

How you’re acquiring them (motion)

Where you’re acquiring them (market)

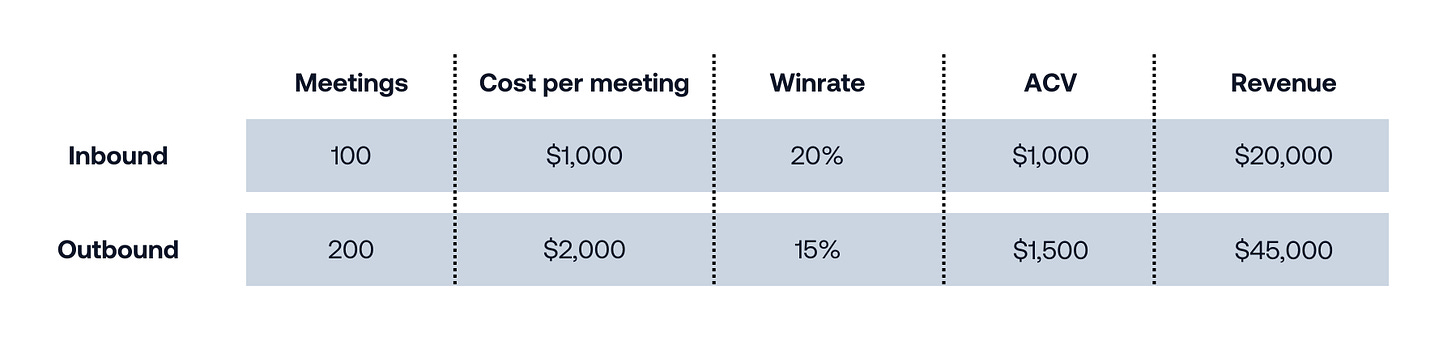

For the sake of brevity (in an already long post), let’s consider inbound and outbound as two motions in one market a SaaS company runs. Across each stage, they behave very differently:

Question: Where should we invest the next $10,000? I bet you chose outbound, and I get it, each meeting represents $225 vs $200 for marketing. But here’s the thing.

Marketing processes much more efficiently, so you’ll actually end up with $2,000 more in revenue vs. $1,125 if you go with outbound.

But in reality, the issues don’t stop there. What if inbound customers renew better? What If they even upsell more?

You probably haven't factored all of this in. And if you have, you probably didn’t split out how inbound vs outbound RENEWS.

If you wish to build a durable business, that’s the lens you need to view your funnel through - especially when unblending it.

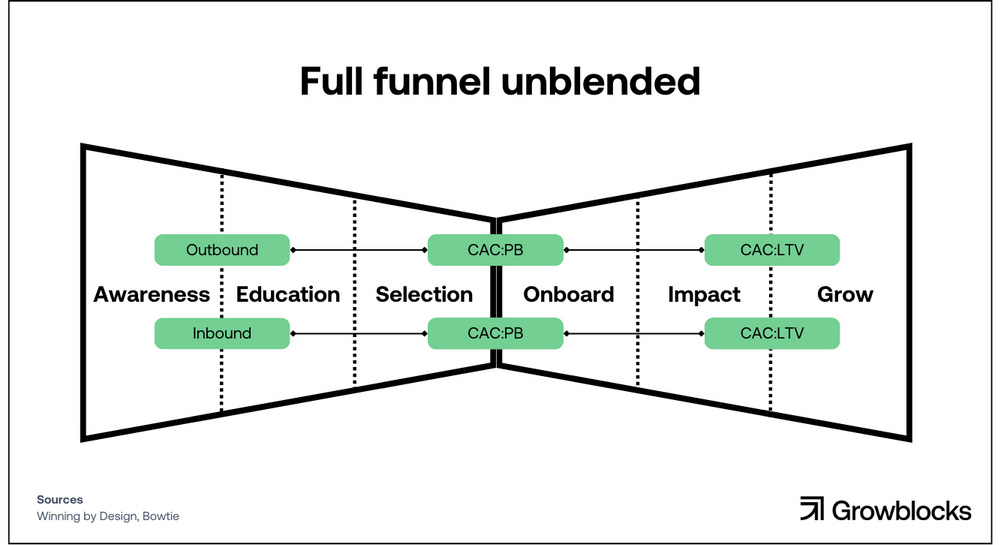

And here’s the best part - once you view the entirety of your business, you realize just how many options you have:

If CAC:PB is increasing, you can work on increasing LTV to afford the higher CAC

If you improve expansion you’ll decrease CAC:PB

But watch out. CAC:PB and CAC:LTV are dangerous. Because your CFO will also be fluent in those. Once that happens you’ll encounter a “cart before the horse” situation.

CAC:LTV needs to be 5x! That means our GRR needs to be 95%, and our CAC:PB needs to go down!

But… this is not how any of these metrics will improve. Instead of top-down, you need to go bottom-up. You need to manage and improve your operational metrics, to get these CFO metrics in the right spot. Using all these frameworks above, helps you to do that.

Metrics matter (until they don’t)

With all of that said, there is one major problem most of us face:

We constantly mess up when it comes to metrics.

If you really want to influence operational change along your engine, hacking one metric at a time is not the game. Improving the business is.

All metrics are interconnected somehow, and understanding those links is key to understanding and improving the business itself.

That’s exactly what we’ll cover in the next post.

This is an epic post — beautifully done.

the combination of all the growth models 👌